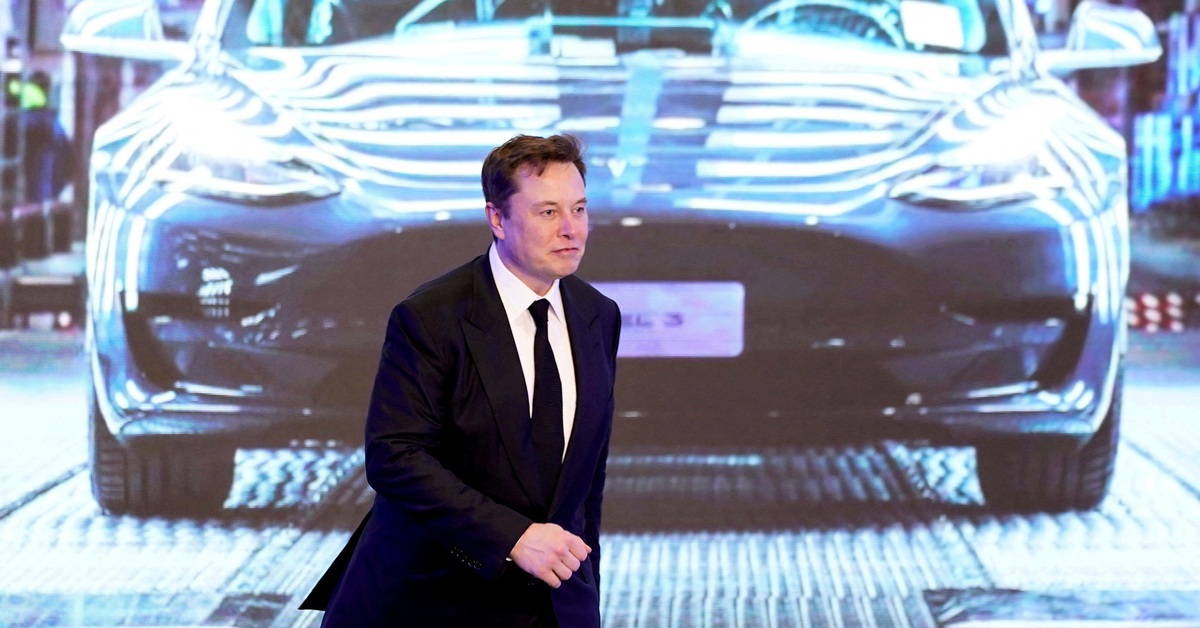

As the world watches the electric‑vehicle giant Tesla navigate its next era, a dramatic showdown is unfolding: Elon Musk’s proposed $1 trillion compensation plan is up for approval, and the board is issuing a stark message to shareholders — vote yes or risk losing Musk’s leadership. This high‑stakes move, covered on the business news program Vantage with Palki Sharma, underscores deep questions about governance, shareholder rights and the future of Tesla’s vision.

:quality(75)/media/dinero/images/2024/06/elon-musk-pago-56-mil-mdd-tesla.jpg)

The Proposal: A Pay Package Like No Other

In early September 2025, Tesla unveiled a compensation package for CEO Elon Musk that is as eye‑wateringly large as it is ambitious. According to regulatory filings:

The plan would grant Musk roughly12 percent of Tesla’s shares in 12 separate tranches — if he meets extremely aggressive performance targets.

The top‑line number being coined:$1 trillion. If Musk hits all milestones, his payout and stake increase could push his worth even higher—and make him likely the first individual in history to surpass that mark via one compensation deal.

To unlock the full package, Tesla must reach a market capitalisation of $8.5 trillion by 2035, deliver 20 million vehicles annually, 10 million paid Full‑Self Driving subscriptions, commercially operate one million robotaxis, manufacture one million humanoid robots (“Optimus”), and have Musk remain in his role for at least 7.5 years.

Additionally, the plan would boost Musk’s voting control in Tesla—from around 13 percent now up toward 29 percent if fully executed.

A major caveat: The plan is performance‑based, tied to long‑term milestones, and subject to shareholder approval on 6 November 2025.

:max_bytes(150000):strip_icc():focal(749x0:751x2)/elon-musk-tesla-080425-ccb15754843b414cb59af2e285472ef0.jpg)

In short: this isn’t just a pay raise. It’s almost a takeover incentive, doubling as a retention tool and a mandate to execute Musk’s futuristic vision for Tesla.

The Ultimatum: Approve or Lose Musk

Behind the numbers lies the real drama. Tesla’s board, through Chair Robyn Denholm, issued a letter to shareholders warning that failure to approve the plan could lead to Musk stepping down or becoming less engaged—potentially harming the company’s future.

Key wording from the letter:

Without Elon, Tesla could lose significant value… our company may no longer be valued for what we aim to become.”

“The fundamental question for shareholders … is simple: Do you want to retain Elon as Tesla’s CEO and motivate him to drive Tesla to become the leading provider of autonomous solutions and the most valuable company in the world?”

That message transforms the vote into a binary: yes means staying the course with Musk, no means risk the exit of the company’s figurehead—and potentially a leadership vacuum.

Why It Matters

This isn’t just another CEO compensation fight. The implications are manifold:

Governance & Shareholder Rights

Critics argue the package is extravagantly large, dilutes shareholder value, consolidates power in one individual, and bypasses meaningful oversight. Advisory firms like ISS and Glass Lewis recommend shareholders vote against the deal.

Meanwhile, Tesla’s board has been criticized for its close ties to Musk—raising questions about independence and whether the board is acting in shareholders’ best interests.

:max_bytes(150000):strip_icc():focal(749x0:751x2)/elon-musk-tesla-080425-ccb15754843b414cb59af2e285472ef0.jpg)

The Future of Tesla

Tesla isn’t just an EV maker—it’s positioning itself as a leader in AI, robotics, autonomous driving, energy storage and mobility services. Musk’s vision is embedded in the company’s identity. The board argues the pay package is the mechanism to keep Musk motivated and aligned with that long‑term vision.

But critics counter: the targets are unimaginably ambitious—an $8.5 trillion market cap is vastly larger than Tesla’s current valuation and any realistic benchmark for the next decade.

The Precedent for Executive Compensation

One executive earning a pay package worth a trillion dollars sets a new benchmark for corporate leadership compensation. It raises questions about how companies reward top executives, how performance targets are structured, and how long‑term incentives align (or don’t) with shareholder returns.

Strategic Leverage & Voting Control

Musk isn’t just seeking money—he’s seeking influence. The plan dramatically increases his voting power at Tesla. In his public appeals he framed the deal as a way to safeguard his control and protect Tesla’s trajectories from outside interference.

The Pushback & Skepticism

Even as Tesla rallies support, the deal faces a range of critiques:

Feasibility of targets: Analysts and commentators note the milestones are unrealistic. For example, delivering 20 million cars annually when Tesla currently sells around a million plus units makes the target daunting. The one‑million robotaxi target is even further out of reach.

Dilution of shareholders: Giving Musk up to 12 percent of shares dilutes existing shareholders’ stakes. Combined with increased voting control, this raises concerns about value transfer away from regular shareholders.

Board independence: Several major institutional investors and state treasurers have formally opposed the package, citing weak board oversight and the board’s inability to challenge Musk when needed.

Timing amidst business headwinds: Tesla’s performance has shown signs of strain—operating income drops, increased competition, geopolitical headwinds—raising doubts about whether now is the right moment to grant unprecedented compensation.

As one TechCrunch commentary bluntly put it: the plan is “full of watered‑down versions of his own broken promises.”

The Board’s Counterpoint

In response, Tesla’s board emphasises two main arguments:

Retention of visionary leadership: The board claims Musk’s singular vision is essential to Tesla fulfilling its transformative mission. The board asserts the plan aligns Musk’s incentives with long‑term shareholder value.

Long horizon, performance based: The plan is not cash up front—it is equity based and only vests if performance criteria are met over years. The board argues this is different from a traditional salary or bonus.

In other words: this is less about paying for past performance, and more about securing future performance and alignment.

:max_bytes(150000):strip_icc()/InvestopediaStructuredContent-ElonMusk-final-266adfdf942a462fa4c7ff09ac633ad3.png)

Key Moments & Timeline

September 5 2025: Tesla publicly files its compensation proposal.

October 2 2025: A group of institutional investors and state treasurers issue a letter urging other shareholders to vote against the package.

:max_bytes(150000):strip_icc():focal(749x0:751x2)/elon-musk-tesla-080425-ccb15754843b414cb59af2e285472ef0.jpg)

October 25–27 2025: Elon Musk, during Tesla’s earnings call, interrupts the CFO and pleads with investors to support the pay plan. He also blasts proxy advisory firms.

October 27 2025: Chair Robyn Denholm issues a letter to shareholders containing the ultimatum: approve or risk losing Musk.

November 6 2025: Tesla’s annual shareholder meeting and vote on the proposal. (Vote closes 11:59 pm ET on November 5)

What Could Happen

If the plan is approved:

Tesla signals to the market that it is doubling down on Musk’s leadership and the AI/robotics future. The precedent of mammoth CEO compensation would be further solidified—potentially affecting other corporate boards. If the plan is rejected: Musk may step down or reduce his involvement, as suggested by the board’s warning. Tesla would need a contingency plan: internal successors, possibly altering its strategic priorities. Shareholder revolt would mark a rare moment of resistance to Musk’s influence—potentially reshaping Tesla’s governance going forward. From a reputational standpoint, Tesla could face instability or renewed leadership uncertainty just as it aims to scale. Final Thoughts

On Vantage with Palki Sharma, several analysts described the moment as a “make or break” inflection point for Tesla. The company is asking shareholders: will you bet everything on Elon Musk’s next decade of vision? Or will you push back on size, structure and governance?

No matter how you slice it, this is a wager: a company built on disruption now faces one of its most disruptive decisions—not technology, but leadership and compensation.

News

NEW Minnesota Fraud Details Reveal How Stolen Cash Was Used: ‘INFURIATING’

In what prosecutors and lawmakers are calling one of the most brazen fraud scandals in recent U.S. memory, new court…

FRAUD SCANDAL: Somali Refugee Calls Out His Own Community

In recent months, a story has emerged that has shocked both local and international observers: a Somali refugee living in…

Elon Musk Just Made a Gigantic Announcement

Elon Musk, the billionaire entrepreneur behind Tesla, SpaceX, and xAI, has recently been at the center of not one but…

Elon Musk’s NEW Discovery on Ilhan Omar Is STUNNING — No One Caught This!

In the modern online ecosystem, a single sensational phrase—“Elon Musk’s new discovery on Ilhan Omar”—is enough to ignite an entire…

Elon Musk Believes DOGE “Was a Little Bit Successful”

In a candid podcast interview released in December 2025, billionaire entrepreneur Elon Musk described his leadership of the Department of…

D4VD ARREST After TEAM AVOIDS JUDGE: THEY ARE PROTECTING THIS MONSTER

In the age of quick-fire social media outrage, even a single anonymous post can erupt into a global narrative—regardless of…

End of content

No more pages to load