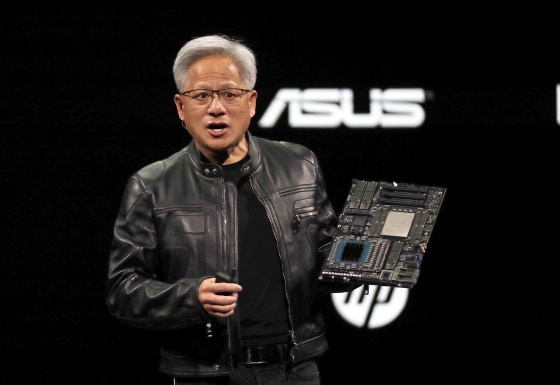

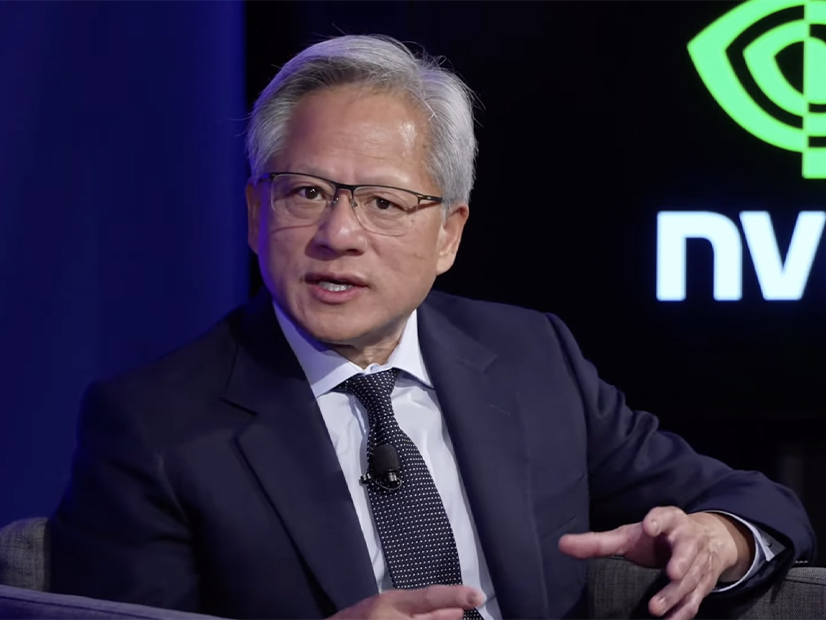

In a recent interview that has caught the attention of the tech world, Nvidia CEO Jensen Huang made a striking statement: he regrets not investing more in Elon Musk’s AI startup xAI and believes that “almost everything that Elon is part of, you really want to be part of as well.” This admission offers a revealing window into Huang’s strategic mindset—and Nvidia’s broader ambitions in the rapidly evolving AI ecosystem.

Nvidia, xAI & the Musk Connection

Huang’s comments arise amid a heightened spotlight on AI infrastructure and the war for dominance in generative AI. Nvidia, long a leader in high‑end GPUs and AI hardware, is doubling down on its role as enabler and investor in next‑generation AI platforms.

In October 2025, Huang told CNBC that while Nvidia is already an investor in xAI, his one major regret was not giving them more money. “The only regret I have about xAI — we’re an investor already — is that I didn’t give him more money. You know, almost everything that Elon is part of, you really want to be part of as well.”

That quote captures two key threads:

Recognition of Musk’s track record: Huang cites Musk’s ability to build “transformative companies” like Tesla and SpaceX as a factor in his desire to be involved.Nvidia’s broader investment strategy: Huang frames the investment in xAI not just as a supplier‑customer relationship (selling chips) but as a strategic stake in a “really great future company.”

He also clarified that it isn’t simply vendor financing (i.e., giving money so the startup will buy Nvidia chips) — instead, the aim is to invest in the startup as a partner, in its potential for growth and impact.

Why This Matters

This seemingly off‑hand remark signals far more than admiration. Here are a few reasons why Huang’s statement is worth attention:

Strategic alignment with Musk’s ventures

By saying he wants to be part of “almost everything Elon is part of,” Huang acknowledges that Musk’s ventures (autonomous cars, rockets, AI, robotics) represent major infrastructure bets. Nvidia is positioning itself as a key player in that infrastructure. For example, Tesla’s full‑self driving and Autopilot systems rely on high‑performance compute—areas where Nvidia excels.

Elevating Nvidia from supplier to ecosystem partner

Traditionally, Nvidia has been viewed as a hardware provider. Huang’s language suggests a shift: investing in startups, aligning with their roadmaps, and making strategic bets upstream. This may allow Nvidia to capture more value—not just from chips sold, but from whole company growth.

The magnitude of the AI investment wave

Huang commented that the shift from CPU to GPU computing for generative AI is only beginning and represents a “multi‑trillion‑dollar build‑out.” Showing active willingness to invest in startups led by high‑profile founders signals Nvidia wants to be a leader in that wave, not just a participant.

Investor and industry signal

For shareholders and the market, Huang’s remarks may signal more aggressive capital deployment, broader strategic partnerships, and deeper alignment across the AI ecosystem—including with Musk’s high‑profile projects. Tech industry watchers may view this as Nvidia placing big bets on future paradigms.

The Layers of Huang’s Remark

Let’s unpack the statement in more detail:

Almost everything that Elon is part of, you really want to be part of as well.”

Acknowledging Musk’s Brand and Momentum

Huang doesn’t mince words: Musk has built transformative companies, and Huang sees that as a track record worth aligning with. It reflects respect, but also business pragmatism: if you believe in the ecosystem Musk assembles, you want a seat at the table.

Investment as Strategic Positioning

Huang’s regret about not having invested more is revealing: Nvidia is already in the game, but wants a bigger share. That can be interpreted as a recognition of missed opportunity—and a desire to not miss again. As one article put it: “He called it an investment into a really great future company.”

Beyond Vendor‑Customer Dynamics

By stressing that the investment is not “vendor financing,” Huang distances Nvidia from the notion of simply selling hardware to Musk’s companies. Instead, Nvidia wants to be a partner in the growth journey. That subtle shift in role—from supplier to strategic investor—has implications for how Nvidia will approach its business going forward.

:max_bytes(150000):strip_icc()/GettyImages-2235491023-3d9cea1d65dc4d40884c5f134d512f81.jpg)

Risk and Reward

Implicit in this statement is recognition of risk: investing in startups (even those led by star founders) comes with uncertainty. But Huang seems comfortable with that, suggesting Nvidia accepts risk in exchange for potential outsized payoffs. And given his comments about the multi‑trillion‑dollar infrastructure build, the upside is large.

Potential Impacts and Considerations

What might this mean in practice? Here are several possible outcomes and implications:

• Expanded Nvidia‑Musk collaboration

We may see deeper collaborations between Nvidia and Musk‑owned or Musk‑affiliated companies (Tesla, SpaceX, xAI, Neuralink, etc.). This could range from joint R&D, dedicated hardware supply agreements, to equity partnerships.

• More aggressive investment strategy

If Huang feels he’s underinvested in Musk’s ventures, Nvidia may allocate more capital to startups and growth companies, especially those linked to Musk or aligned with Nvidia’s AI/dataset ambitions. This could affect how it directs capital and where it sees strategic value.

• Ecosystem influence and market positioning

By aligning with high‑visibility projects, Nvidia may bolster its position as the “default infrastructure” for next‑gen AI. That could create momentum and reinforce its dominance—but also increase scrutiny (from regulators, competitors, and market watchers) about integration, ecosystem power and dependency.

• Investor expectations

Shareholders may expect Nvidia to show not only hardware growth but ecosystem partnerships, equity stakes, and strategic bets. If Nvidia does not execute accordingly, the market could question whether the ambition translates into performance.

• Risk of over‑exposure

On the flip side, aligning closely with Musk and his projects carries risk: Musk‑led ventures often have high variance (big successes, big controversies). Nvidia could be exposed to reputational or financial risk if any of those projects falter. Huang’s desire to “be part of everything” may amplify exposure.

Wider Industry Context

Huang’s comments do not exist in a vacuum. They reflect broader industry dynamics:

Generative AI is driving enormous demand for compute, infrastructure, and innovation. Nvidia stands at the heart of that.

The rise of high‑profile AI startups (xAI being one of them) has created a wave of infrastructure demand—and strategic partnerships around that demand.

Tech leaders are no longer just hardware providers; many are becoming ecosystem builders, service providers, and strategic investors.

Huang has also identified that Nvidia’s engineers now universally use AI tools, reflecting the cultural and operational shift within the company. That internal shift parallels Nvidia’s external bets.

Critical Questions Moving Forward

While Huang’s statement is bold, it leads to several questions:

How much additional capital will Nvidia allocate to ventures like xAI or other Musk‑adjacent companies?

What will the governance and structure of these partnerships look like? Will Nvidia simply be an investor, or will it take board seats, co‑developer roles, or joint ventures?

What is the competitive landscape? If Nvidia becomes deeply tied to Musk’s ecosystem, how will it balance relationships with other tech firms, startups, and platforms?

How will regulators respond? As Nvidia deepens its strategic ties in AI infrastructure, questions about monopolistic power, vertical integration, and competitive fairness may arise.

Will the risk pay off? Aligning with high‑stakes ventures means high rewards—but also high pressure. Execution will matter.

Conclusion

Jensen Huang’s public admission that he wishes Nvidia had invested more in Elon Musk’s xAI and his broader comment that “almost everything that Elon is part of, you really want to be part of as well” are more than off‑hand remarks. They reveal a strategic pivot: Nvidia is not content to provide hardware alone—it aims to be a foundational partner in the AI universe Musk is helping build.

For Nvidia, this could mark a shift into deeper ecosystem integration, broader investment deployment, and heightened ambition. For the wider tech world, it signals that the race for AI dominance is no longer just about chips—it’s about partnerships, bets, and aligning with the visionaries who shape the future.

News

FRAUD SCANDAL: Somali Refugee Calls Out His Own Community

In recent months, a story has emerged that has shocked both local and international observers: a Somali refugee living in…

Elon Musk Just Made a Gigantic Announcement

Elon Musk, the billionaire entrepreneur behind Tesla, SpaceX, and xAI, has recently been at the center of not one but…

Elon Musk’s NEW Discovery on Ilhan Omar Is STUNNING — No One Caught This!

In the modern online ecosystem, a single sensational phrase—“Elon Musk’s new discovery on Ilhan Omar”—is enough to ignite an entire…

Elon Musk Believes DOGE “Was a Little Bit Successful”

In a candid podcast interview released in December 2025, billionaire entrepreneur Elon Musk described his leadership of the Department of…

D4VD ARREST After TEAM AVOIDS JUDGE: THEY ARE PROTECTING THIS MONSTER

In the age of quick-fire social media outrage, even a single anonymous post can erupt into a global narrative—regardless of…

KYLIE JENNER “REMOVES HER BBL,” BEYONCÉ IS “DONE WITH JAY-Z,” AND SOFIA RICHIE “PREGNANT AND CHEATED ON”: INSIDE THE VIRAL RUMOR MACHINE

In an era where a TikTok video filmed in a bedroom can ignite headlines worldwide, celebrity narratives spread faster—and mutate…

End of content

No more pages to load