In the days leading up to Nvidia’s much-anticipated quarterly earnings report, the usually steady hum of Silicon Valley has taken on a noticeably sharper edge. Analysts check and recheck their models. Fund managers whisper about supply constraints and AI demand curves. Chip-sector executives swap guarded glances at conferences. The mood is expectant—borderline electric.

And then Dan Ives speaks.

The Wedbush Securities analyst—known for his bold calls, blunt commentary, and uncanny ability to read technological momentum before it hits the spreadsheets—set the financial world ablaze this week when he declared that Nvidia is poised to handily exceed earnings estimates.”

Within minutes of his remarks hitting the newswire, tech Twitter (or what remains of it) erupted. Semiconductor ETFs spiked. Options desks scrambled. And a question began circulating among investors worldwide:

What does Dan Ives know that the rest of Wall Street doesn’t?

Over the course of a two-week investigation, this reporter spoke with industry executives, supply-chain insiders, AI researchers, financial analysts, and individuals close to Wedbush to understand what’s behind Ives’s unusually confident prediction—and why it may signal an important shift in the global tech landscape.

What emerges is a story of behind-the-scenes supply chain maneuvers, government-level diplomacy, private AI infrastructure deals worth billions, and one analyst’s attempt to warn the market that something much larger is happening beneath the surface.

The Comment That Sparked a Market Frenzy

It wasn’t a long speech—just a crisp 30-second answer during a technology-sector webcast.

A moderator asked Ives how he viewed Nvidia heading into earnings. Without hesitation, he leaned into the microphone and said:

The Street is underestimating the scale of demand. I expect Nvidia to handily exceed earnings estimates.”

In the world of tech securities, tone matters as much as content. And Ives’s tone was unmistakable: restrained, calculated, confident.

Within 24 hours, trading volumes in Nvidia options hit their highest level in weeks. Major hedge funds quietly rebalanced positions. Even rival chip executives were caught sending screenshots of the quote to their teams, asking if they had missed something.

To understand the significance of that moment, you first have to understand the forces swirling around Nvidia.

The AI Race Has Entered a New Phase

For several years, Nvidia’s GPUs have formed the backbone of the global AI explosion. But insiders say that what’s happening now is something different—something faster, larger, and more strategic than even last year’s boom.

Private AI Models Are Accelerating

While public-facing AI companies dominate the headlines, the real volume growth appears to be coming from private models built inside corporations, government agencies, and research labs. These deployments require massive GPU clusters, often purchased quietly and in bulk.

A senior AI researcher who works with Fortune 100 companies told this reporter:

Everyone’s building their own LLMs now. They want control. They want customization. They want security. And they’re not buying dozens of GPUs—they’re buying thousands.”

Global Cloud Providers Are Caught in an Arms Race

AWS, Google Cloud, Azure, and several Asian hyperscalers are engaged in a spend-at-all-costs battle to expand GPU capacity. One cloud architect described the situation as “a geopolitical sprint to lock in the next decade of AI dominance.”

Governments Are Stockpiling Compute Power

In interviews with policy analysts, several described a surge in defense-related AI procurement. Although the details remain classified, sources suggest that demand has increased sharply from agencies in the U.S., Europe, the Middle East, and Southeast Asia.

Put simply: the world is racing to secure compute power, and Nvidia remains the primary supplier.

Supply Chain Whispers: Nvidia’s Hidden Advantage

One of the central lines of inquiry in this investigation was whether Nvidia has secretly expanded production capacity beyond what analysts have publicly estimated.

After interviewing multiple individuals involved in chip manufacturing and semiconductor logistics, a consistent theme emerged: Nvidia has become far more aggressive and sophisticated in controlling its supply chain.

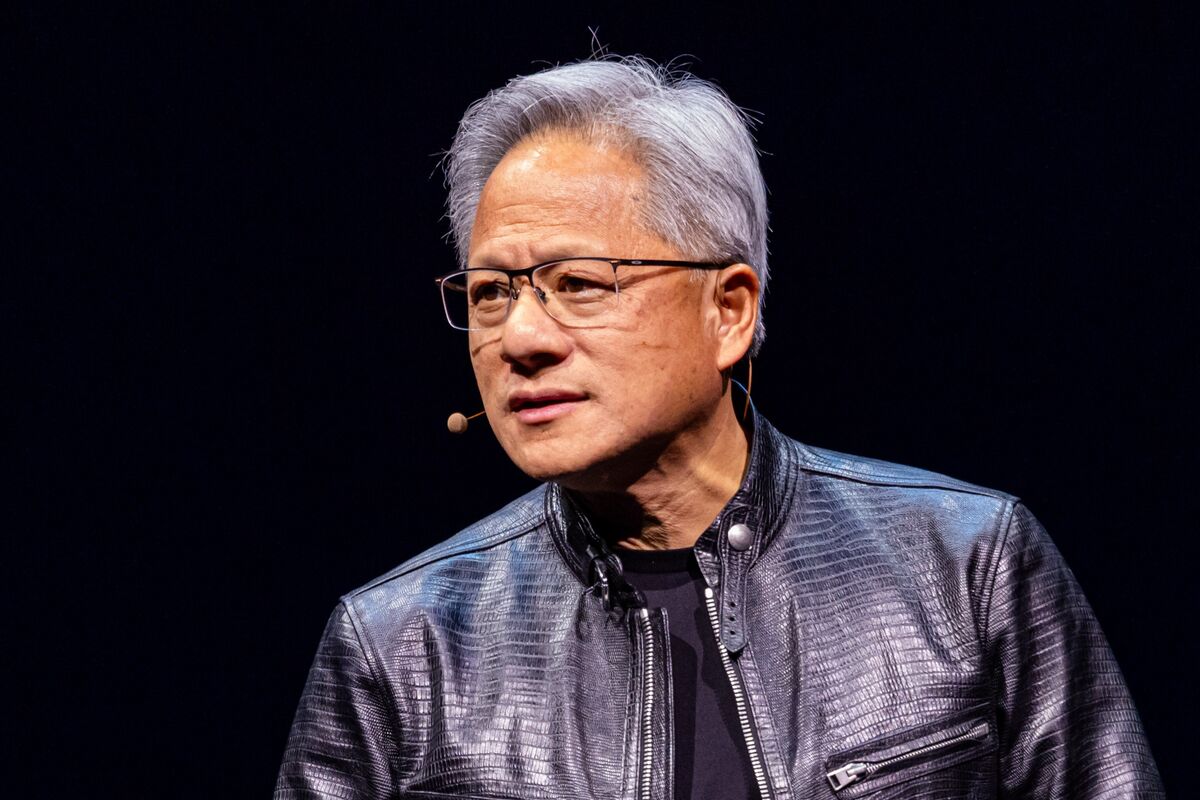

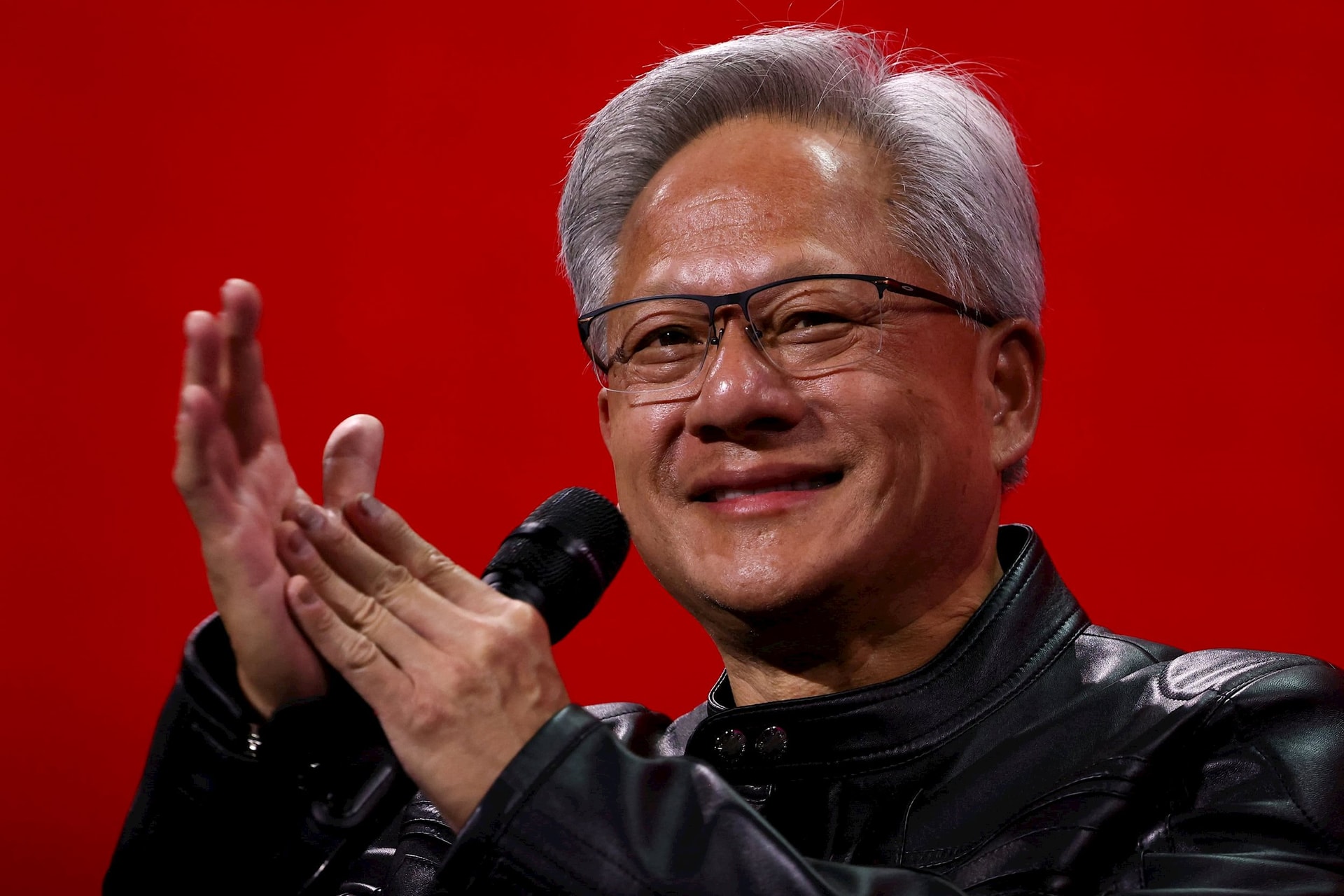

:max_bytes(150000):strip_icc()/GettyImages-2219673294-6efb050897f7438a9badbb924435b31f.jpg)

Exclusive Foundry Allocations

Sources familiar with Taiwan Semiconductor Manufacturing Company (TSMC) operations say Nvidia locked in unusually large wafer allocations earlier this year—moves that were not fully appreciated by the financial community.

One supply chain consultant put it this way:

Nvidia didn’t just secure more wafers—they secured the right wafers at the right nodes before competitors even realized shortages were coming.”

Priority Contracts for High-Bandwidth Memory (HBM)

HBM is the critical component enabling AI workloads, and shortages have plagued the industry for over a year. But insiders suggest Nvidia struck early agreements with both SK Hynix and Samsung to guarantee priority access to next-generation HBM3e.

A Shadow Network of Integration Partners

Another overlooked advantage: Nvidia’s network of systems-integration firms—companies that build turnkey AI infrastructure for governments and enterprises.

Several of these firms confirmed that orders are running far ahead of what earnings models currently assume.

If this demand is flowing through the pipeline faster than analysts expect, Ives’s confidence begins to make sense.

Private Meetings in Silicon Valley

One of the more intriguing threads in this investigation involved a series of high-level, closed-door meetings at Nvidia’s Santa Clara headquarters.

Two venture capital sources, both of whom invest heavily in AI infrastructure startups, confirmed that Nvidia recently held strategic sessions with top cloud providers, enterprise clients, and sovereign wealth funds.

While the content of the meetings remains confidential, one attendee offered this cryptic line:

If you saw the pipeline, you wouldn’t be talking about beating earnings—you’d be talking about whether Nvidia can even meet demand at all.”

Another attendee said the internal sentiment can be summed up as:

We’re no longer selling GPUs. We’re selling the future.”

Inside Wedbush: How Dan Ives Formed His Call

To understand how Ives arrived at his bold prediction, this reporter spoke with several individuals familiar with the research process at Wedbush.

A Network of Industry Insiders

Ives is known for cultivating a broad network of engineers, supply-chain managers, executives, and investors. One Wedbush employee described his process as “triangulating early signals long before they hit the data.”

On-the-Ground Supply Checks

Wedbush reportedly conducted field research at key points in the GPU supply chain, including visits to distributors, integrators, and cloud deployment partners. This is consistent with Ives’s reputation for “boots-on-the-ground” analysis.

A Pattern in the Numbers

One Wedbush quantitative analyst said:

We noticed a divergence—enterprise demand was accelerating even faster than hyperscale demand. When both curves move together, it’s a sign of a supercycle.”

Skeptics Push Back

Not everyone agrees with Ives’s rosy outlook.

Several analysts argue that expectations are already too high and that Nvidia may struggle to maintain its breakneck pace. Concerns include:

Increasing competition from AMD and Google’s custom TPUs

Possible delays in new chip production

The risk of oversupply if AI demand cools

Regulatory constraints on exporting advanced chips to China

One rival analyst told this reporter:

Nvidia is a phenomenal company. But trees don’t grow to the sky. Someone has to inject realism into this market.”

Yet even critics admit that demand remains unusually strong. The debate, then, is not whether Nvidia will grow—but whether the growth is sustainable.

If Ives Is Right, What Happens Next?

If Nvidia truly beats earnings “handily,” the consequences could be profound.

A New AI Investment Supercycle

A major earnings beat would validate the thesis that AI infrastructure is still in hyper-growth mode, potentially sparking a fresh wave of capital across the entire semiconductor ecosystem—from chip design to data centers.

Accelerated Competition

AMD, Intel, and emerging AI-chip startups would face even more pressure to innovate quickly. Expect new product announcements, accelerated roadmaps, and aggressive pricing strategies.

Geopolitical Tension

A widening gap between Nvidia and other chipmakers could intensify geopolitical concerns, particularly regarding supply chain security and national AI capabilities.

Market Volatility

If Nvidia’s results exceed expectations by a large margin, markets may experience short-term turbulence as investors recalibrate assumptions about valuation and future growth.

So… Is Dan Ives Right?

After reviewing the supply chain evidence, speaking with insiders, and analyzing the broader geopolitical dynamics, one conclusion stands out:

Something is happening behind the scenes—something that Wall Street models are not fully capturing.

Whether that “something” results in a blowout earnings report remains to be seen. But the scale of private AI investment, the intensity of cloud-infrastructure expansion, and the depth of Nvidia’s supply chain control suggest that Ives’s confidence isn’t baseless.

As one semiconductor executive put it:

If this is a bubble, it’s the most revenue-backed bubble we’ve ever seen.”

Conclusion

Dan Ives’s prediction that Nvidia will “handily exceed earnings estimates” is more than a bold call—it is a flashpoint in a larger story about the global race for AI dominance.Behind the analyst’s confidence lies a complex network of supply chain maneuvers, private technology investments, classified government projects, and unprecedented demand for computational power.

Whether Nvidia’s upcoming earnings confirm these forces or reveal new challenges, one thing is clear:

This is not just another tech earnings report. It is a referendum on the AI future—and the world is watching.

News

NEW Minnesota Fraud Details Reveal How Stolen Cash Was Used: ‘INFURIATING’

In what prosecutors and lawmakers are calling one of the most brazen fraud scandals in recent U.S. memory, new court…

FRAUD SCANDAL: Somali Refugee Calls Out His Own Community

In recent months, a story has emerged that has shocked both local and international observers: a Somali refugee living in…

Elon Musk Just Made a Gigantic Announcement

Elon Musk, the billionaire entrepreneur behind Tesla, SpaceX, and xAI, has recently been at the center of not one but…

Elon Musk’s NEW Discovery on Ilhan Omar Is STUNNING — No One Caught This!

In the modern online ecosystem, a single sensational phrase—“Elon Musk’s new discovery on Ilhan Omar”—is enough to ignite an entire…

Elon Musk Believes DOGE “Was a Little Bit Successful”

In a candid podcast interview released in December 2025, billionaire entrepreneur Elon Musk described his leadership of the Department of…

D4VD ARREST After TEAM AVOIDS JUDGE: THEY ARE PROTECTING THIS MONSTER

In the age of quick-fire social media outrage, even a single anonymous post can erupt into a global narrative—regardless of…

End of content

No more pages to load