In the world of technology, finance, and cryptocurrency, few names provoke as much discussion as Elon Musk and Michael Saylor. Musk, CEO of Tesla, SpaceX, Neuralink, and other ventures, is renowned for his disruptive approach to innovation, while Saylor, CEO of MicroStrategy, has become one of the most prominent institutional advocates for Bitcoin.

Recently, Musk publicly stated that he “agrees with Michael Saylor,” a remark that immediately caught the attention of financial analysts, cryptocurrency enthusiasts, and media outlets around the world. On the surface, it may appear as a simple alignment of opinion, but beneath the headline lies a complex convergence of economic philosophy, technological vision, and risk assessment. This article explores the substance behind Musk’s statement, analyzing what Saylor advocates, where Musk aligns, and the broader implications for markets, investors, and society.

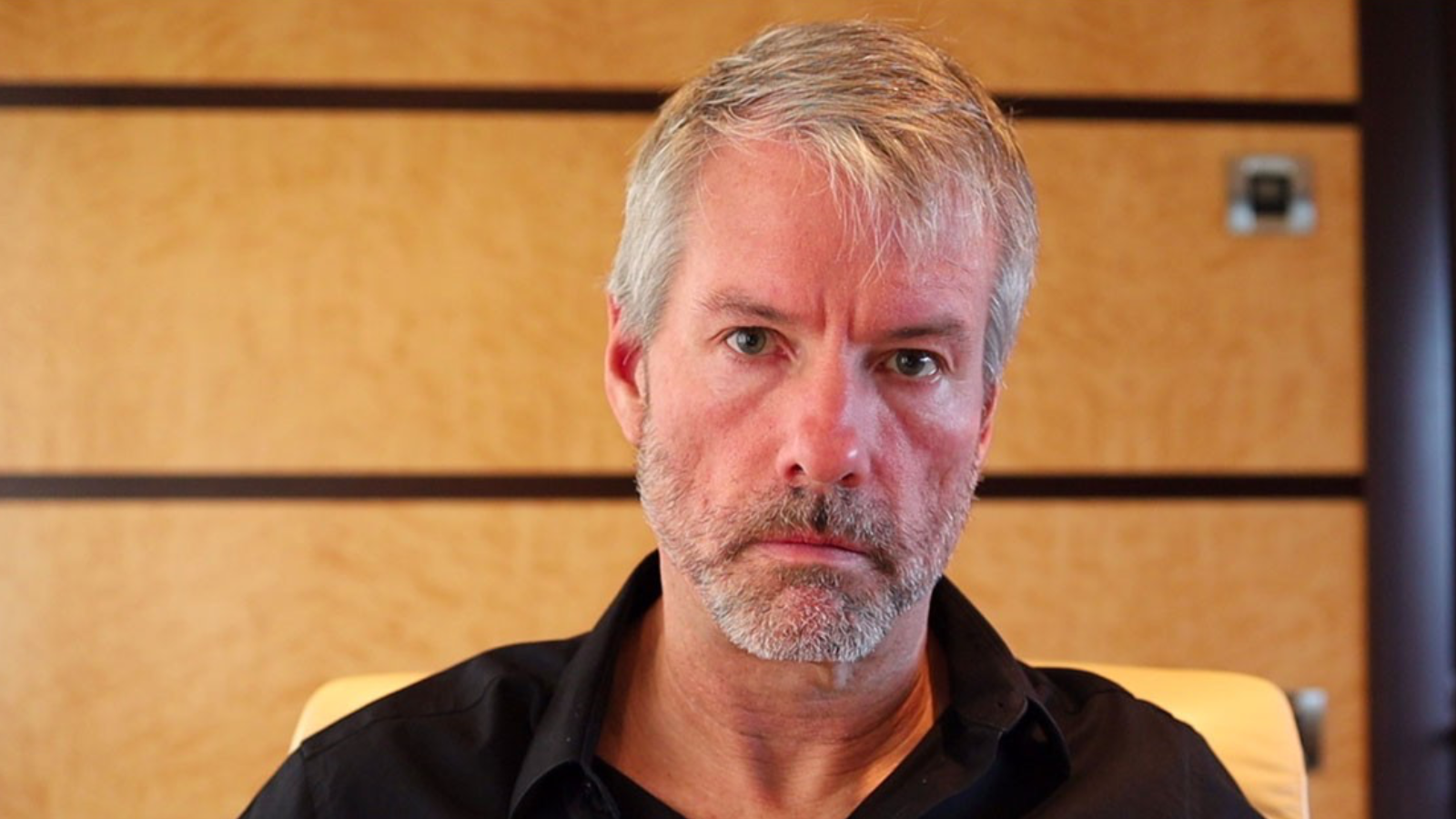

Who Is Michael Saylor and What Does He Represent?

Michael Saylor, co-founder and executive chairman of MicroStrategy, has become widely known for his advocacy of Bitcoin as a store of value. Under his leadership, MicroStrategy converted significant portions of its corporate cash reserves into Bitcoin, marking a turning point in how corporations might approach digital assets.

Bitcoin is a superior store of value compared to cash. According to him, fiat currencies are inherently prone to inflation, devaluation, and mismanagement by central banks. In contrast, Bitcoin, with its fixed supply and decentralized nature, offers a hedge against monetary inflation and a mechanism for preserving wealth over time.

Saylor has consistently framed Bitcoin not as a speculative asset, but as a strategic treasury reserve — a digital gold for the modern economy. His public persona revolves around transforming the perception of cryptocurrency from a niche or speculative investment into a mainstream institutional tool.

Elon Musk’s Relationship with Cryptocurrency

Elon Musk has historically had a nuanced and sometimes volatile relationship with cryptocurrency. From supporting Dogecoin in a playful, social-media-driven manner to Tesla’s high-profile Bitcoin purchase and subsequent suspension due to environmental concerns, Musk’s positions have been both influential and unpredictable.

Despite this, Musk has shown moments of alignment with Saylor’s views, particularly regarding the role of scarce assets as a hedge against currency devaluation. Musk has publicly expressed skepticism about holding cash in inflationary environments, emphasizing that physical assets or scarce resources may retain value better than fiat currency. This philosophical overlap with Saylor forms the basis of the recent statement that Musk agrees with Saylor.

The Tesla-Bitcoin Connection

The alignment between Musk and Saylor gained practical significance during Tesla’s corporate Bitcoin investment in early 2021. Saylor publicly advised Musk that moving corporate reserves into Bitcoin would be a “favorable strategic choice” and could yield long-term benefits. Musk acknowledged these ideas and ultimately authorized Tesla to purchase $1.5 billion worth of Bitcoin, marking one of the largest corporate crypto acquisitions at the time.

While Tesla’s Bitcoin holdings have fluctuated due to market volatility and Musk’s own environmental concerns, the episode demonstrates a tangible moment of convergence between Musk and Saylor: both recognized the potential of Bitcoin as a strategic asset beyond mere speculation.

Philosophical Alignment: Cash, Scarcity, and Value

Musk’s endorsement of Saylor’s views is rooted in a broader economic philosophy. Both billionaires share skepticism toward fiat currencies in times of monetary expansion and high inflation. They advocate for:

Diversifying reserves into scarce assets: Unlike cash, Bitcoin has a finite supply, providing a hedge against devaluation.

Reconsidering the nature of corporate treasuries: Companies may benefit from holding assets that preserve value over decades rather than cash that erodes in purchasing power.

Technological optimism with economic prudence: Both Musk and Saylor view technological solutions as essential for addressing systemic challenges in the financial system, albeit from different angles.

This philosophical convergence is critical because it reframes the public perception of cryptocurrencies: not merely as speculative tools for traders, but as instruments for corporate strategy and long-term financial planning.

Market Implications of Musk’s Agreement

Musk’s public statement aligning with Saylor has multiple implications for financial markets:

Investor Confidence: Musk’s endorsement can boost investor confidence in Bitcoin and other cryptocurrencies. His influence is vast, and any positive sentiment expressed publicly can trigger significant market movements.

Institutional Adoption: Companies observing Tesla and MicroStrategy may consider adding Bitcoin or other digital assets to their balance sheets, potentially normalizing crypto as a legitimate corporate reserve.

Volatility Concerns: While institutional endorsement may drive adoption, it may also increase price volatility. Musk’s statements have historically caused short-term market swings, highlighting the dual nature of influence.

Narrative Shift: By aligning with Saylor, Musk contributes to changing the narrative around Bitcoin from a fringe speculative asset to a recognized component of modern financial strategy.

Divergence Between Musk and Saylor

Despite the alignment, there are notable areas of divergence between Musk and Saylor:

Environmental Concerns: Musk has openly criticized Bitcoin’s energy-intensive mining, which led to Tesla suspending Bitcoin payments at one point. Saylor, on the other hand, has emphasized Bitcoin’s strategic value over environmental concerns.

Corporate Strategy: Saylor’s approach positions Bitcoin as central to MicroStrategy’s corporate identity. Musk, however, prioritizes Tesla and SpaceX’s operational businesses, with Bitcoin remaining a secondary consideration.

Public Communication: Musk is famously unpredictable in public statements, sometimes contradicting previous positions. Saylor tends to maintain consistent messaging focused on long-term strategic vision.

These differences underscore that while Musk agrees with Saylor conceptually, their alignment is selective and contextual, rather than a full-scale adoption of Saylor’s strategy.

Ethical and Societal Implications

The convergence of Musk and Saylor on Bitcoin raises broader questions about the societal impact of cryptocurrency adoption:

Economic Inequality: The benefits of Bitcoin may disproportionately favor early adopters and wealthy institutions, potentially widening the wealth gap.

Environmental Sustainability: Large-scale cryptocurrency mining consumes significant energy, raising concerns about environmental sustainability.

Financial Stability: Widespread corporate adoption of volatile assets could introduce systemic risks if market corrections occur rapidly.

Global Monetary Policy: If corporations increasingly hedge against fiat devaluation, traditional monetary policy could be challenged, potentially affecting central banks’ ability to stabilize economies.

These considerations indicate that alignment between two high-profile figures is significant, but not without risk or controversy.

Community and Media Reactions

The statement “I agree with Michael Saylor” generated widespread discussion across media and social platforms:

Crypto Enthusiasts: Many celebrated the alignment, viewing it as institutional validation of Bitcoin’s strategic relevance.

Financial Analysts: Analysts cautioned against over-interpreting public statements, highlighting the volatile nature of cryptocurrency markets.

Mainstream Media: Headlines ranged from admiration for visionary leadership to skepticism about risk exposure and environmental consequences.

Overall, the reactions reflect both excitement and caution — mirroring the broader debate surrounding cryptocurrency’s role in global finance.

Potential Future Scenarios

Considering Musk’s alignment with Saylor, several plausible future scenarios emerge:

Increased Corporate Adoption: More companies may diversify their reserves into Bitcoin or similar scarce assets.

Regulatory Evolution: Governments and regulators may introduce frameworks to address corporate cryptocurrency holdings, influencing market behavior.

Market Growth with Volatility: Institutional adoption could stabilize long-term perception but also increase short-term price swings.

Shift in Financial Norms: If major corporations adopt digital assets, traditional concepts of money, value storage, and treasury management could be reshaped.

These scenarios highlight the transformative potential of Musk and Saylor’s shared perspective — while also emphasizing the complexity and uncertainty involved.

Challenges and Unanswered Questions

Despite the alignment, several critical questions remain:

Can energy consumption from Bitcoin mining be sustainably managed?

Will regulators worldwide accept cryptocurrency as a mainstream corporate reserve?

How will market volatility affect companies’ willingness to hold digital assets?

What are the social and ethical implications of increased reliance on scarce digital assets?

These questions illustrate that Musk’s agreement with Saylor is only part of a larger, ongoing conversation about finance, technology, and society.

Conclusion

Elon Musk’s statement that he “agrees with Michael Saylor” is more than a casual remark. It reflects a convergence of philosophical and strategic thinking about money, value, and corporate reserves. Both leaders challenge traditional financial orthodoxy, advocating for a future in which scarce assets like Bitcoin play a central role in preserving wealth and hedging against inflation.

At the same time, the agreement is selective, situational, and context-dependent. Environmental concerns, corporate strategy priorities, and public communication differences highlight that Musk’s endorsement is nuanced rather than absolute.

Nonetheless, the alignment is significant. It signals growing institutional acceptance of cryptocurrency, challenges conventional financial practices, and invites society to reconsider long-held assumptions about money and value. As markets, corporations, and regulators navigate this evolving landscape, Musk and Saylor’s alignment will likely remain a focal point for debate, investment strategy, and innovation in financial thought.

Ultimately, Musk’s agreement with Saylor serves as a lens through which we can examine the future of corporate finance, digital assets, and the evolving definitions of wealth in a rapidly changing technological and economic world.

News

NEW Minnesota Fraud Details Reveal How Stolen Cash Was Used: ‘INFURIATING’

In what prosecutors and lawmakers are calling one of the most brazen fraud scandals in recent U.S. memory, new court…

FRAUD SCANDAL: Somali Refugee Calls Out His Own Community

In recent months, a story has emerged that has shocked both local and international observers: a Somali refugee living in…

Elon Musk Just Made a Gigantic Announcement

Elon Musk, the billionaire entrepreneur behind Tesla, SpaceX, and xAI, has recently been at the center of not one but…

Elon Musk’s NEW Discovery on Ilhan Omar Is STUNNING — No One Caught This!

In the modern online ecosystem, a single sensational phrase—“Elon Musk’s new discovery on Ilhan Omar”—is enough to ignite an entire…

Elon Musk Believes DOGE “Was a Little Bit Successful”

In a candid podcast interview released in December 2025, billionaire entrepreneur Elon Musk described his leadership of the Department of…

D4VD ARREST After TEAM AVOIDS JUDGE: THEY ARE PROTECTING THIS MONSTER

In the age of quick-fire social media outrage, even a single anonymous post can erupt into a global narrative—regardless of…

End of content

No more pages to load