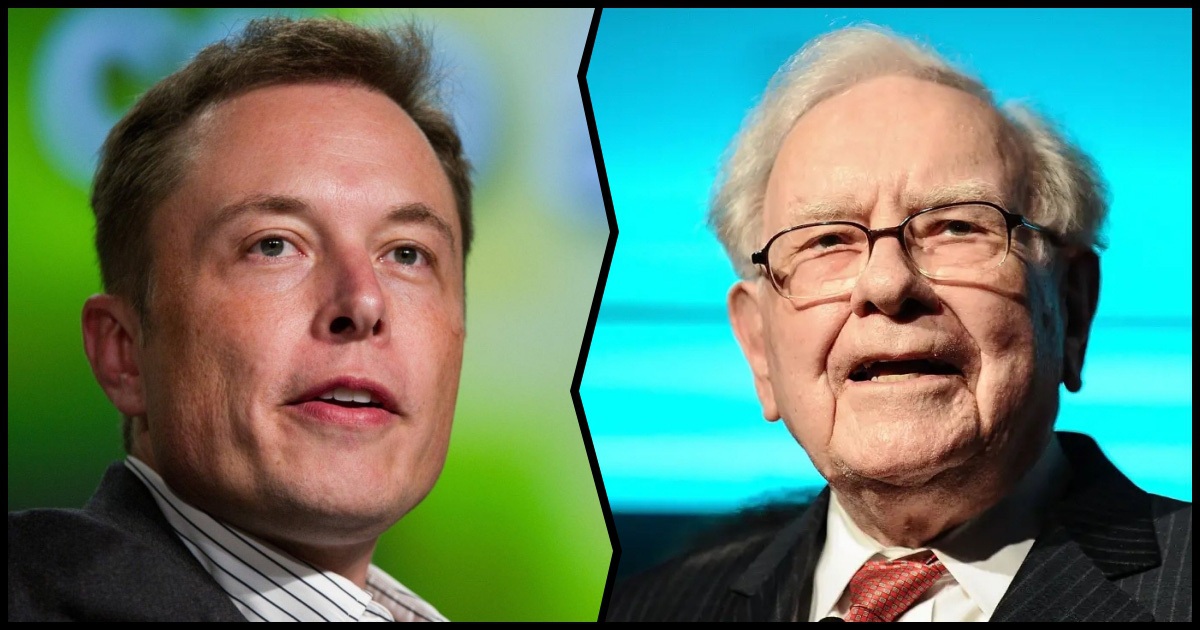

In the rarefied world of legendary wealth and influence, two of America’s most iconic figures—Elon Musk and Warren Buffett—are confronting significant headwinds. For Musk, it’s a confluence of corporate risk, reputational threats and distraction. For Buffett, it’s the twilight of his era, leadership transition pressures and market forces at odds with his legacy. Here’s what’s going on, why it matters, and what they both might be up against.

Elon Musk: A Towering Figure Facing Multiple Cracks

At the height of his reach, Elon Musk seemed untouchable. From electric vehicles and rockets to social platforms and bold public pronouncements, few would bet against him. But a series of developments suggest that the ground may be shifting beneath him.

Over-extension and Strategic Drift

Musk recently acknowledged that he is juggling “17 jobs at once” in his various enterprises. That kind of stretch invites risks: strategic neglect, inability to focus and execution gaps. When the central figure of a sprawling enterprise says such things publicly, investors and watchers take notice.

Brand & Platform Vulnerabilities

One particularly alarming sign: Musk’s empire is showing brand erosion. A recent article reported Musk’s missteps at his social-platform business (X) and the increasing dislocation between his public persona and stable corporate governance. Moreover, a significant protest movement called “Tesla Takedown” is targeting his companies globally with vandalism and reputational risk.

Regulatory & Political Back-Pressure

Musk now finds himself embroiled in regulatory and governmental pressure. For instance, a notable blackout or service disruption at X triggered serious questions about platform stability. He also might be stepping down from a federal role he took on, signaling uncertainty and possible distraction.

What this means for Musk

When your public narrative shifts from “technical visionary changing the world” to “multifaceted tycoon under strain,” the risk profile changes. Executives lose bandwidth, brand trust declines, and investors grow wary. For Musk, these signals collectively represent awful news because the foundation of his empire relies on confidence—in leadership, innovation, platform stability and public goodwill.

Warren Buffett: The Oracle Under Transition and Pressure

If Musk’s challenges are about momentum and turbulence, Warren Buffett’s challenges are about legacy, succession and market realities. Buffett has been the stable face of value investing for decades. But now, he faces perhaps his toughest transition yet.

Retirement & Leadership Succession

At age 94, Buffett announced he will step down from leading Berkshire Hathaway by year-end, recommending his successor, Greg Abel. The announcement surprised many and invites questions: will the culture of Berkshire remain consistent? Will shareholders be comfortable during the transition?

Market Reaction & Wealth Decline

Buffett’s net worth reportedly dropped by about US $8.1 billion following the retirement announcement and a sharp drop in Berkshire’s Class B shares. Even the “Oracle of Omaha” can be vulnerable to market cycles—and when he’s known for stability, such shifts are notable.

Strategic Headwinds

The mega-cash pile Buffett sits on (hundreds of billions) is a double-edged sword: while it offers opportunity, it also places pressure on realizing returns in a low-interest environment. Moreover, international trade risks and tariffs—a concern Buffett himself flagged—could weigh heavily on conglomerates like Berkshire with global exposure.

What this means for Buffett

Buffett’s awful news is subtle but significant: the era of him being the steady, unshakable anchor appears to be transitioning. Succession, market headwinds and the sheer weight of expectation might converge to challenge his legacy. Investors may start asking: is the “safety” of Buffett’s brand still intact when he’s no longer at the helm?

Why Their Challenges Are Interconnected

Though Musk and Buffett operate in different spheres—Musk in tech and disruption, Buffett in value investing and conglomerates—their troubles reflect a broader theme in modern business: immense scale + legacy/brand = amplified risk.

Both rely heavily on public perception: Musk for innovation and charisma; Buffett for trust and discipline. When either is questioned, the business beneath is vulnerable.

Both are facing >transition moments: Musk in diversifying and juggling too many roles; Buffett in stepping back after decades. Transitions generate uncertainty.

Both are operating in volatile times: regulatory scrutiny, geopolitical risk, platform trust issues, interest rate pressures—all of these amplify the potential for fall-offs.

In that sense, the “awful news” isn’t just about individual missteps—it’s about structural risk to power, brand, legacy and control.

Potential Fallout & Key Risks to Watch

For Musk

Investor flight: If Tesla, X or other Musk ventures fail to deliver as expected, investors may look for safer bets.

Brand damage: Continued protests, vandalism or high-profile platform failures could erode public trust faster than growth can compensate.

Leadership fatigue: If Musk is managing 17 jobs, something may give. Critical ventures could suffer from lack of focused leadership.

For Buffett

Management transition shock: Greg Abel’s appointment is known—but the era of Buffett is ending. Will shareholders pay a “transition tax” (i.e., lower valuations) until new leadership proves itself?

Macro/geopolitical risk: Tariffs, slowing global trade, and cash-yield pressures may hurt returns. If Berkshire fails to adapt, the value proposition changes.

Legacy risk: Buffett has long preached discipline and long-term value. If Berkshire underperforms in his absence, the narrative of “invincible Buffett” could fade.

How They Could Respond

Musk’s possible corrective moves

Narrow focus: Prioritise fewer ventures to ensure execution excellence rather than breadth.

Address reputation and platform vulnerability: Work on stabilising X, strengthening Tesla’s brand, and managing public backlash.

Transparent governance: Given public recognition of stretch, Musk may need to delegate more and strengthen executive teams to reassure stakeholders.

Buffett’s strategic adaptations

Smooth transition: Ensure Greg Abel and others are showcased as capable and the culture remains intact.

Active communication: Reassure shareholders that the value discipline continues. Use the transition as a narrative of continuity, not disruption.

Opportunistic investing: With cash in hand, the new leadership could double down on value opportunities in market dislocations—turning uncertainty into advantage.

The Bigger Picture: Why This Matters

When two of the most influential figures in global business show signs of stress, it signals much more than individual trouble—it reflects shifting paradigms.

Markets: Investors anchored in mythic figures (Musk as tech savior, Buffett as value guru) may be facing a re-calibration.

Culture of power: Leadership transitions and brand vulnerabilities are increasingly visible; authority and infallibility are less guaranteed.

Strategic timing: Both men built empires in a different era—now the rules (platform trust, regulatory complexity, global competition) are changing.

In short, we’re witnessing more than two business icons under pressure—we’re seeing the old playbook of empire building and reputation management being stress-tested.

Final Thoughts

Yes—the news is awful for Elon Musk and Warren Buffett, but not necessarily catastrophic. What’s concerning is the accumulation of warning signs: over-extension, brand vulnerability, leadership transition, macro headwinds. These aren’t isolated incidents—they reflect deeper structural shifts.

For Musk, the question is whether empire-building will catch up with scale and complexity. For Buffett, the question is whether the legacy built over decades can transition cleanly into a new era of leadership and market turbulence.

What’s at stake is not just their personal fortunes, but the narratives their careers have embodied: innovation unstoppable, value always wins. If those narratives crack, the broader implications for business, investing and leadership are profound.

In the years ahead, both men will be watched not simply as moguls of yesterday, but as case studies for what happens when even the most powerful face transition, threat and a changing world. And if you’re wondering: Yes, this is what we’re up against.

News

NEW Minnesota Fraud Details Reveal How Stolen Cash Was Used: ‘INFURIATING’

In what prosecutors and lawmakers are calling one of the most brazen fraud scandals in recent U.S. memory, new court…

FRAUD SCANDAL: Somali Refugee Calls Out His Own Community

In recent months, a story has emerged that has shocked both local and international observers: a Somali refugee living in…

Elon Musk Just Made a Gigantic Announcement

Elon Musk, the billionaire entrepreneur behind Tesla, SpaceX, and xAI, has recently been at the center of not one but…

Elon Musk’s NEW Discovery on Ilhan Omar Is STUNNING — No One Caught This!

In the modern online ecosystem, a single sensational phrase—“Elon Musk’s new discovery on Ilhan Omar”—is enough to ignite an entire…

Elon Musk Believes DOGE “Was a Little Bit Successful”

In a candid podcast interview released in December 2025, billionaire entrepreneur Elon Musk described his leadership of the Department of…

D4VD ARREST After TEAM AVOIDS JUDGE: THEY ARE PROTECTING THIS MONSTER

In the age of quick-fire social media outrage, even a single anonymous post can erupt into a global narrative—regardless of…

End of content

No more pages to load